how insurance companies can orchestrate the best user journeys with CIAM

User Journey Orchestration is ultimately about delivering great user experiences. And for insurance companies, that means connecting channels and customising the user experience based on your target audience, your brand and the right level of trust.

Setting the scene

Over the past 5 years, the insurance market has been flooded with aggregators providing product & price comparisons off the shelf. In some cases, these aggregators have nearly replaced the need for intermediary agents or brokers to sell insurance products. At the same time, there’s been a major shift among consumers towards buying insurance online and even via their mobile phone.

These changes have added significant pressure to insurance companies’ price margins. It’s harder than ever for insurers to compete on price alone when selling new products and retaining existing customers. That’s why insurance companies have quickly learned the importance of offering their customers a smooth user journey.

The identification process

So, how can an insurance company verify the identity of a customer who is buying their insurance through their laptop or phone? One method is to use digital identity verification systems (like eIDAS/eID) built by governments, or commercially available equivalents provided by companies. These include Electronic ID (eID) options like:

- FranceConnect (used in France)

- Verimi (Germany)

- iDIN or eHerkenning (Netherlands)

- itsme (Belgium)

- BankID (Sweden)

- Gov.UK Verify (UK)

These eIDs make the identification process very easy for consumers, as they can reuse an existing, trusted and known single online identity to identify themselves. There’s no need for them to go through any offline process, evaluated manually. And these identification methods create a high degree of trust.

So, these identification options are a great choice for insurance companies across Europe. Plus, they are increasingly common. At our last count, there are 35 eIDAS nodes which have successfully passed the conformance test of the EU, and that number is growing rapidly.

Digitalising legacy (paper-only) systems

Some insurance companies are hundreds of years old and store large amounts of customer data in legacy systems. In some cases, those systems are paper-only. So, how can insurance companies bring these customers into the digital world

Simply establishing their identity is not enough. It’s also important to match those identities against the information available in-house and identify the customer as a policyholder. This is where we step in. OneWelcome does all the work of connecting to digital identity systems (eIDAS) from different countries and different services from within insurance companies, so you can continue focusing on your core business.

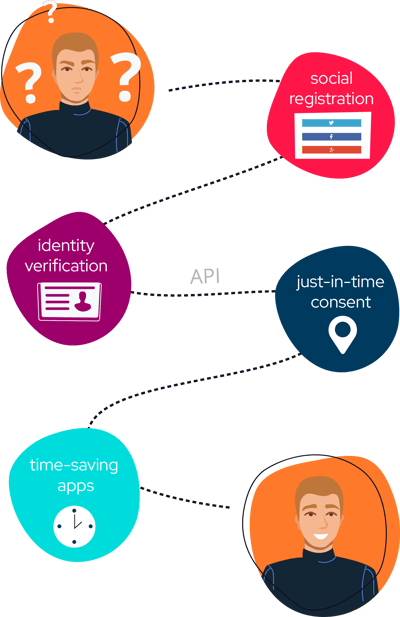

Registration/onboarding

Most insurance companies offer different services under different brands, each targeting a different user group. To ensure a consistent user experience, it’s important to offer a customised registration/onboarding process for each brand with steps that cater to the target audience. One-size-fits-all is no longer an option.

When it comes to choosing the right onboarding process, your choices range from the minimalistic end of spectrum (i.e., a just-in-time registration with only an email (and not even password) for prospect consumers), to the higher end of the spectrum with Identity validation (like iDIN), matching, mobile phone number verification for 2FA and other steps, as well as the possibility of registering a user and doing a step-up to collect more data, as and when needed).

With more consumers now buying insurance products ‘à la carte’, choosing different services from different labels, OneWelcome offers you a buffet where each brand from within your company can pick its own onboarding steps and orchestrate a user journey specifically targeted to their audience. This provides you with the best of both worlds: customised user experiences for each brand, yet with a minimum of technical complexity and maintenance.

Each step from this buffet is plug & play. All this flexibility along with the possibility of having a single identity per user across brands, means that when a consumer buys a new product, they can reuse the same identity (with or without step-up if needed). So, with a Single Sign-On (SSO), they can access all the products they’ve bought from your company, no matter which brand.

Read the whole series

This is part 2 of a series of 5 posts about Customer Identity and Access Management challenges in the Insurance industry.

You can read the rest of the series here:

- The best customer experience for Insurance, with CIAM

- How Insurance companies can orchestrate the best User Journeys with CIAM

- Passwords are the problem!

- B2B2C for Insurance: How to serve different user groups

- Conversion from prospect to customer